Economics Behind Satellite Megaconstellations

Swarming above our heads, satellites form a constellation (or swarm) whenever several work together to achieve the same goal. A first such goal was set back in the late 1980s: when Motorola dreamt up a large constellation of satellites enabling people to call home from any spot around the globe. A more recent (2010s) constellation built by Planet Labs had the goal of remote sensing, where many satellites would image the complete surface of the earth every day to “index the Earth and make it searchable, the way Google indexes the internet”. Both of these constellations were technological marvels yet, at least initially, struggled to turn their ambitions into a profit generating venture.

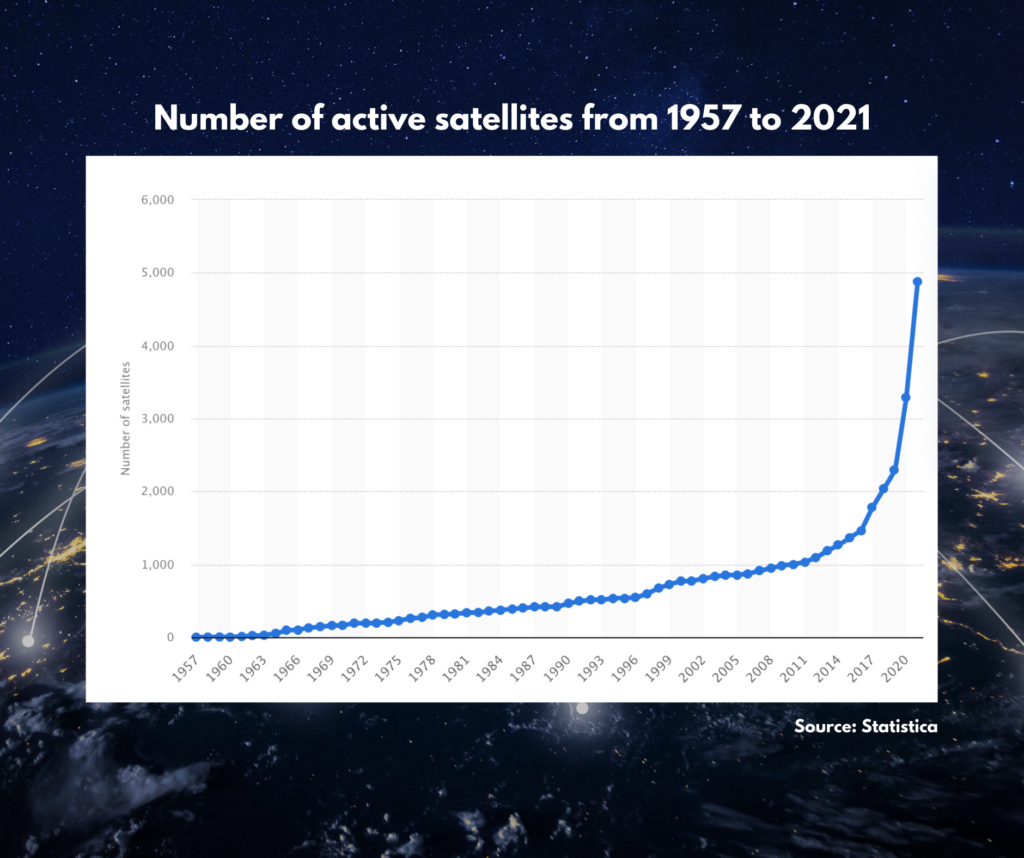

Today, SpaceX, the most valuable U.S. startup, is taking this to another level: with already 3,500 broadband internet satellites launched as part of the Phase 1 Starlink constellation, the company is taking major strides to get to the planned 4,400 first-generation satellites in orbit by 2023, a year earlier than planned. SpaceX is making previous generation constellations seem puny by lifting 60 satellites to orbit per launch, where the Iridium constellation consisted of 66 satellites in total. Other companies like OneWeb are similarly competing for a slice of the broadband connectivity pie, with 428 satellites in orbit of the 648 planned, but are clearly struggling with the business case. The now decade-old feud between Musk and Bezos is also battled in the world of satcoms, with Amazon pushing for their own constellation through project Kuiper, planning to send up 3,276 broadband internet satellites. The first one is, however, yet to be launched.

Today’s push for satellite constellations shows no lack of ambition, though the immense capital requirements have forced various attempts into bankruptcy. So just how well do the numbers add up?

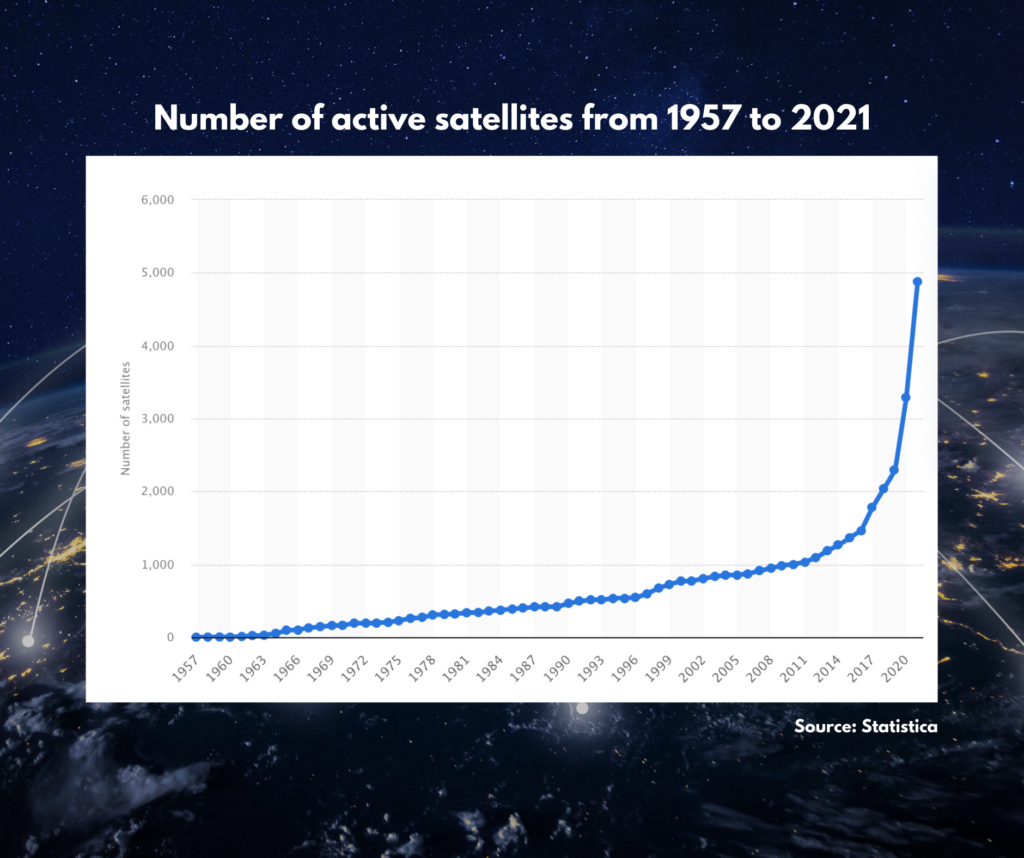

Motorola’s pioneering Iridium satphone constellation required exactly 66 satellites to achieve global coverage, in doing so providing a voice service with its first successful call in 1998. This ~$5 billion technological feat however turned into a sizable commercial disaster. Planned in the late 1980s, its business plan was locked in for over 12 years before becoming operational in 1998, by then offering phone calls from a $3,000 brick-sized phone for $6-30/minute – far more expensive than landlines. The late 1980s value proposition furthermore focussed on providing voice services to remote places where regular cell phones would not work, yet by the time the Iridium service was commercially available, terrestrial networks had greatly expanded and covered areas in far more remote places than initially anticipated by the company’s management. And to make matters worse, customers now also demanded data. The satellites’ transmission rates peaked at 2.4 kilobits/sec, taking more than 1 hour to download 1 megabyte. Heavily indebted, Iridium was unable to pay its loans when onboarding just 20,000 subscribers in its first year of operation, needing more than double that to cover its interest payments. These compounding commercial issues forced Iridium to file for chapter 11 by August 1999, turning it into one of the largest bankruptcy cases of the 90s after having invested $5b.

The company was restructured and turned around in the early 2000s with the help of four investors throwing ‘good money after bad’, a mere $25 million that is, further aided by a sizable Pentagon contract. So how much money did Iridium make over the following two decades? And, how does it stack up against the $5b invested?

For the sake of simplicity we will assess Iridium’s net income over the years. Iridium (Communications Inc.)’s oldest annual report is from 2009, when it acquired its predecessor company Iridium Holdings LLC. This report lists the finances back to 2005 and, thus, we are unable to accurately account for net income generated in the first years of the restructuring, although we can extrapolate the net income growth rate of the years 2005-2009 (5%) backwards to get an idea. Furthermore, this analysis solely looks at net income generated up to and including 2016, as since 2017, 48 of the original satellites have decayed and are no longer operational (also note that Iridium started launching their second generation satellites in 2017). The sum of the net income generated by Iridium between 2001-2016 is approximately $750m, averaging out at $46m per year. Crudely speaking, and without taking into account cost of capital (nor ownership of Iridium), we are talking about a return on investment of -85%. Ouch.

In the world of earth observation, Planet Labs Inc. pioneered a large constellation in pursuit of their Mission 1: to image the Earth’s landmass every day. The company, with a classic Silicon Valley origin story starting with seven employees working out of a garage in Cupertino in 2011, achieved its goal in 2017 using a constellation of over 200 medium and high-resolution satellites and having grown to nearly 500 people around the world.

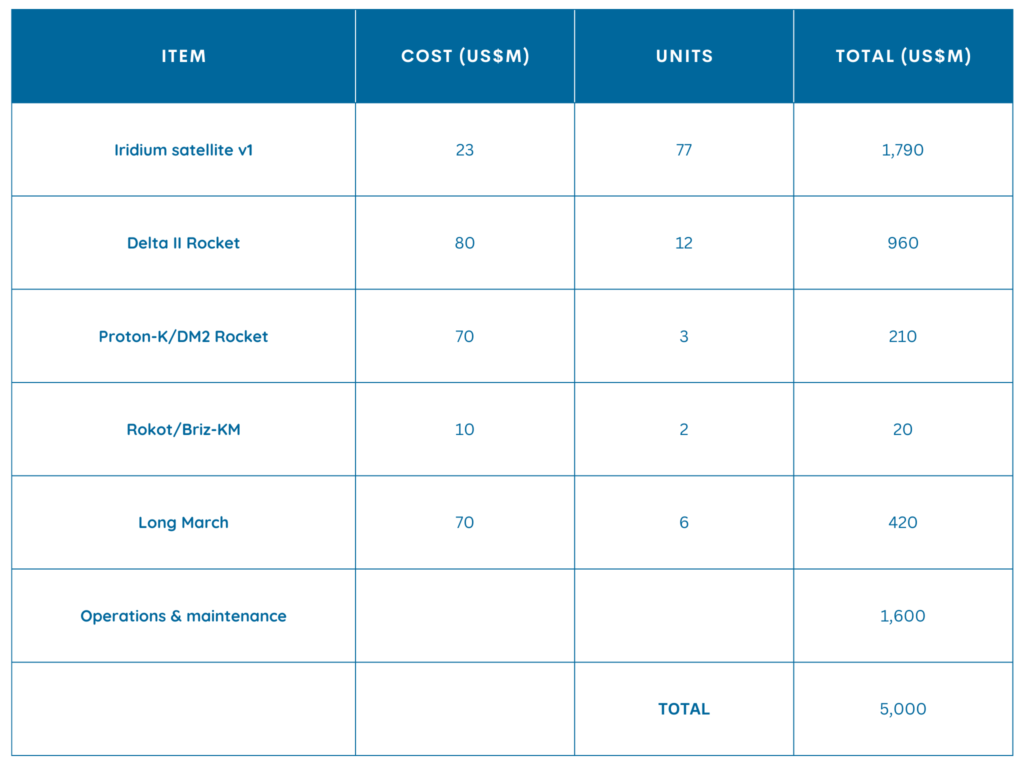

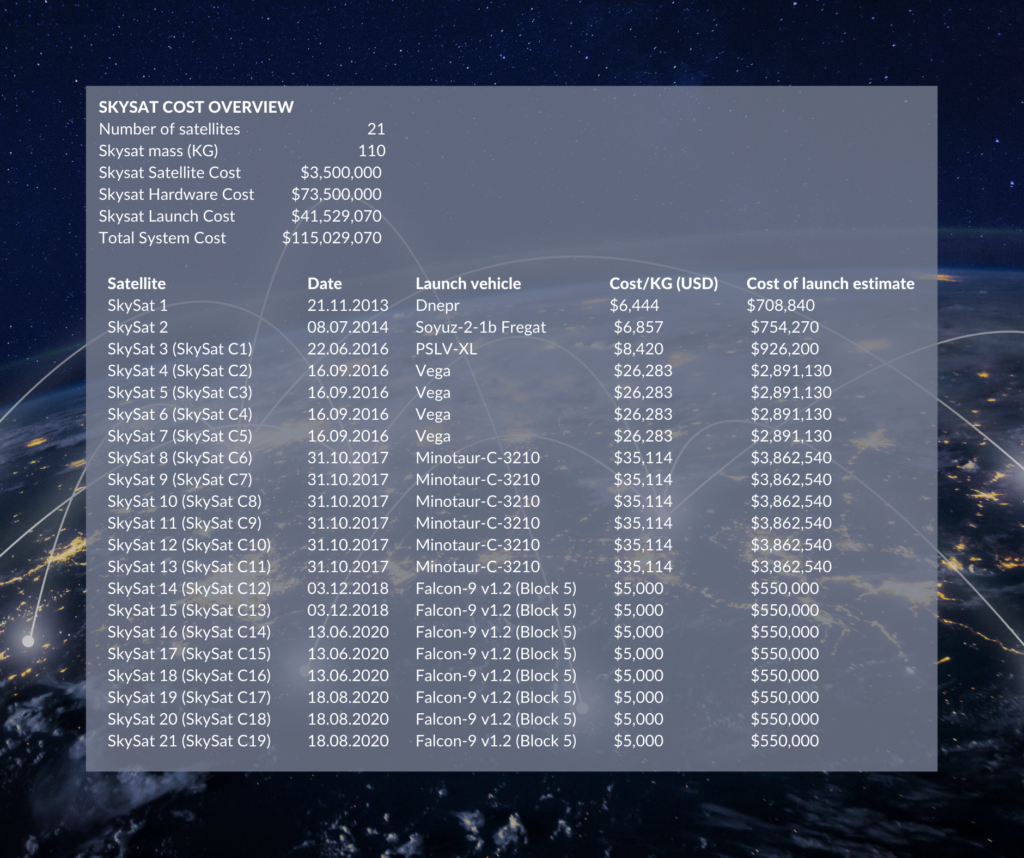

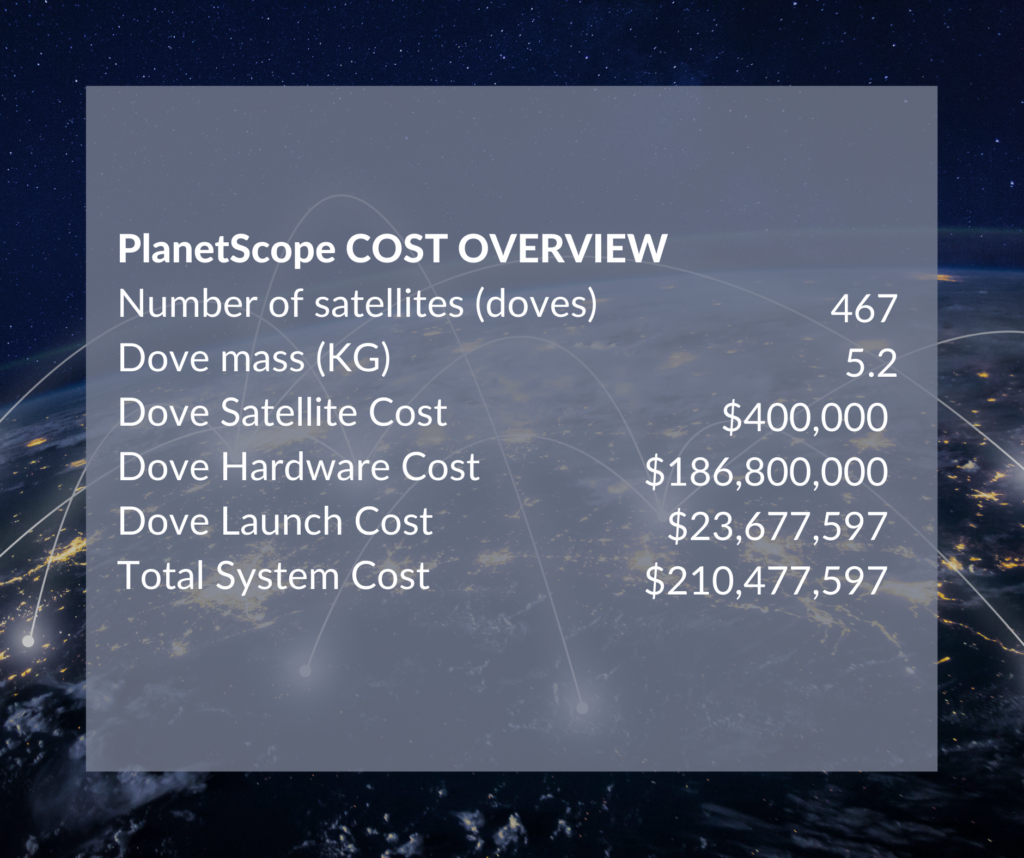

Diving into the invested capital, we are looking at both Planet’s Skysat constellation (larger 110KG satellites producing 30cm resolution images with 21 satellites in orbit) and the Planetscope constellation (5.2KG shoebox-sized satellites producing 3-5m resolution images with over 400 launched and 200 currently operational in orbit). See the Skysat overview below:

The Skysat hardware cost takes the average of the $2 to 5 million estimate, which combined with the launch costs puts the system’s cost at approximately $115m. A similar exercise was performed for the PlanetScope system and its Dove satellites including all launches, where the Dove hardware cost of $400,000 is estimated based on this article, citing that it is ‘well into the six figures’.

Out of the $573m raised by Planet, likely over $300m went into the realization of the constellations, also considering that this analysis does not include the required ground stations and related hardware. Recent insights into their financials prior to its SPAC merger (a fast-track public offering of shares, a trend we covered earlier this year), showed that, even with decent revenue growth over the last five years (27% CAGR, growing from $43 million in 2016 to $113 million in 2021), Planet remains unprofitable and does not expect to become profitable before 2025, 14 years after its inception.

It recently announced the all-new Pelican constellation to replace its high-resolution SkySat constellation, boasting up to 32 satellites, 30cm resolution images, and up to 30 revisits per day. Will such efforts, along with planned increases in sales account executives and marketing spend (2.5x and 2x respectively), help the company realize its forecasted revenue growth from $113 million in 2021 to almost $700 million in 2026? Time will tell, although their recent quarterly report indicates good progress with up to 43% YoY forecasted growth in 2023.

Previous constellations struggled with commercial viability (some more than others, see also OneWeb which is not covered here). SpaceX, however, believes the time is ripe for an internet-providing mega constellation. Lower launch costs are critical for its commercial viability, pioneered by SpaceX’ reusable Falcon 9 first stage (one of which recently saw its 13th flight), and taken to the next level with its upcoming Starship vehicle.

Development of the Gen1 Starlink satellites and related infrastructure should have started some time before Musk’s first announcement of their plans in January 2015, which was immediately followed by a $1b series G investment by Google. SpaceX therefore took approximately 5 years to design, build and deploy the first 60 (v0.9) test Starlink satellites. By the time the v0.9 batch launched, consequent funding rounds (six in total) raked in another $2b by 2019. That puts the total US dollars invested up until the first deployment at ~3b.

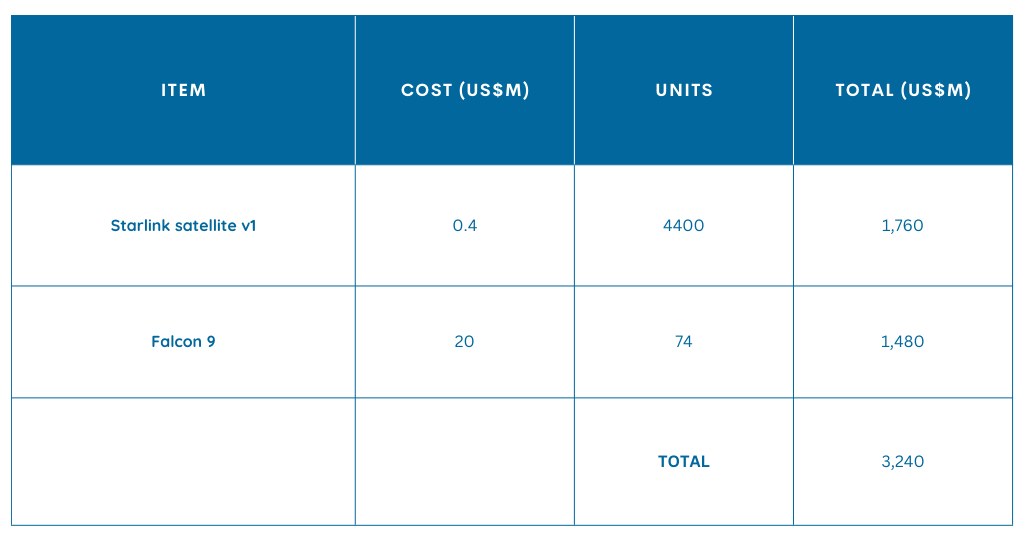

In 2019, Elon Musk and SpaceX COO, Gwynne Shotwell, said the cost of a single Starlink satellite to be well below $500,000, and that the cost of launching Falcon 9 was already significantly less than the cost of its payload of Starlink v0.9 satellite prototypes. 60 Starlink satellites stacked in a single payload fairing, and the cost of a starlink satellite conservatively estimated at ~$400,000, puts the payload value at ~$25 million. Internal launch costs to SpaceX may then be approximated to ~$20 million. So, the ballpark price tag to produce and fly the 4,400 first generation Starlink satellites is >$3b, on top of the $3b invested so far.

On to customers: the Starlink service came online in 2019, and since then its user base has seen rapid growth; starting at 10,000 users in February 2021 and reaching over 700,000 by September 2022, showing good potential to hit the one million mark by the end of 2022. With yearly subscription fees of $1,320 ($110/month), Starlink is currently looking at $1.3b in yearly subscription revenues. A continued exponential growth rate might see the number of users come close to 10 million by 2025, generating $12b+ in subscription revenues.

Musk previously aimed for $30b in revenues by 2025, although that might be ambitious, if not from a demand viewpoint then certainly from a supply viewpoint. To serve such a large number of subscribers adequately, SpaceX will need a lot of satellites. A Starlink Gen1 satellite provides 20Gbps in bandwidth, and if SpaceX targets a 100Mb/s allocation per user, that means 10m*100Mbps = 1 million Gbps of required bandwidth. Of course, not every user will be using the full bandwidth at all times, so perhaps a more reasonable number to account for is 250,000 Gbps by oversubscribing the Gen1 network four-fold, which can be realized with 12,500 satellites. This would be in line with SpaceX’ 2018 intention to get 12,000 satellites in orbit by the end of their “Phase 2” in 2027 – though it seems their Phase 2 plans may have already changed.

Musk has indicated that financially the Gen1 satellite is weak, and that the case for the new Gen2 satellite is strong, undoubtedly due to their increased performance. In a 2020 FCC filing, SpaceX indicated Gen2 would have 3x the bandwidth, and more recently Musk talked about 10x more capable Gen2 satellites. So what’s next? There is some indication SpaceX does not plan on launching the remaining 7,600 Phase 2 satellites anymore, and instead may focus on getting the Gen2 constellation approved and launched to complement and eventually replace the first generation, instead. The Gen2 constellation was mentioned by SpaceX in an FCC filing in October 2022, planning to orbit 30,000 satellites and anticipating weekly launches of the second generation satellites in 2023.

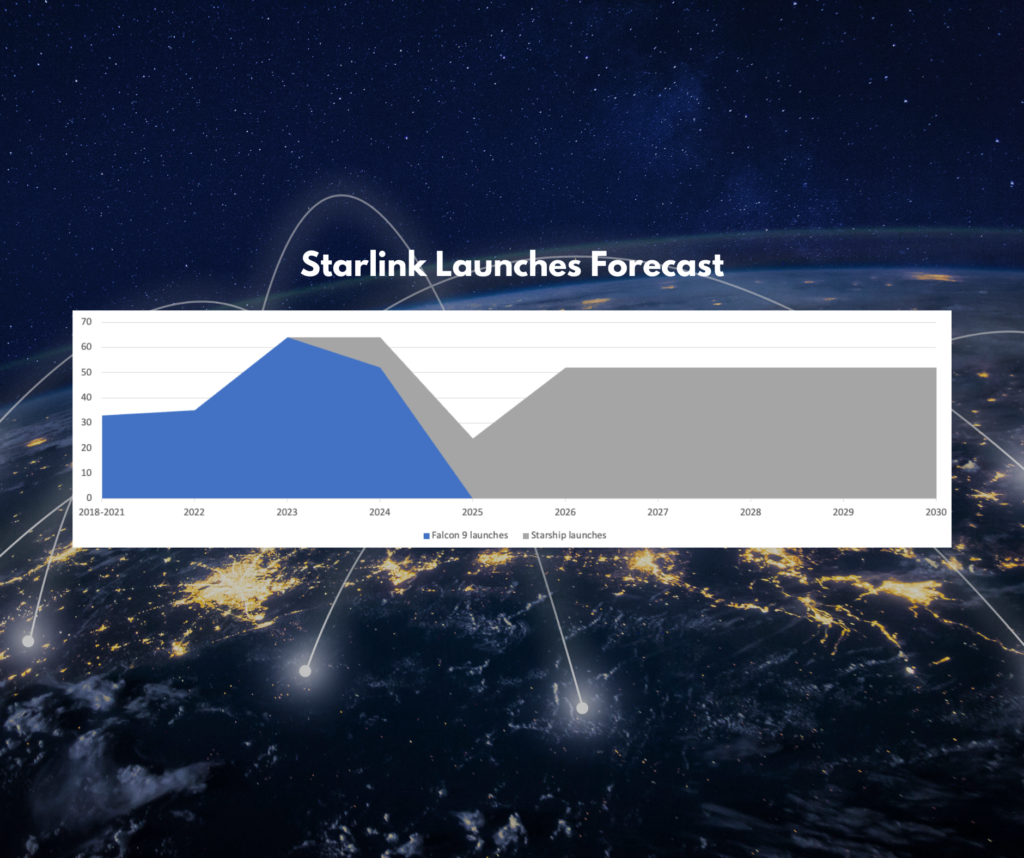

To get the Gen2 satellites in orbit, SpaceX initially planned on solely using Starship, SpaceX’ latest super-heavy and fully-reusable vehicle. Starship’s development has seen success recently, though the raptor engine production line was ‘in crisis’ back in 2021. Likely due to Starship development/production delays, SpaceX now has decided it will start using Falcon 9 and a downsized Gen2 satellite to speed up the deployment.

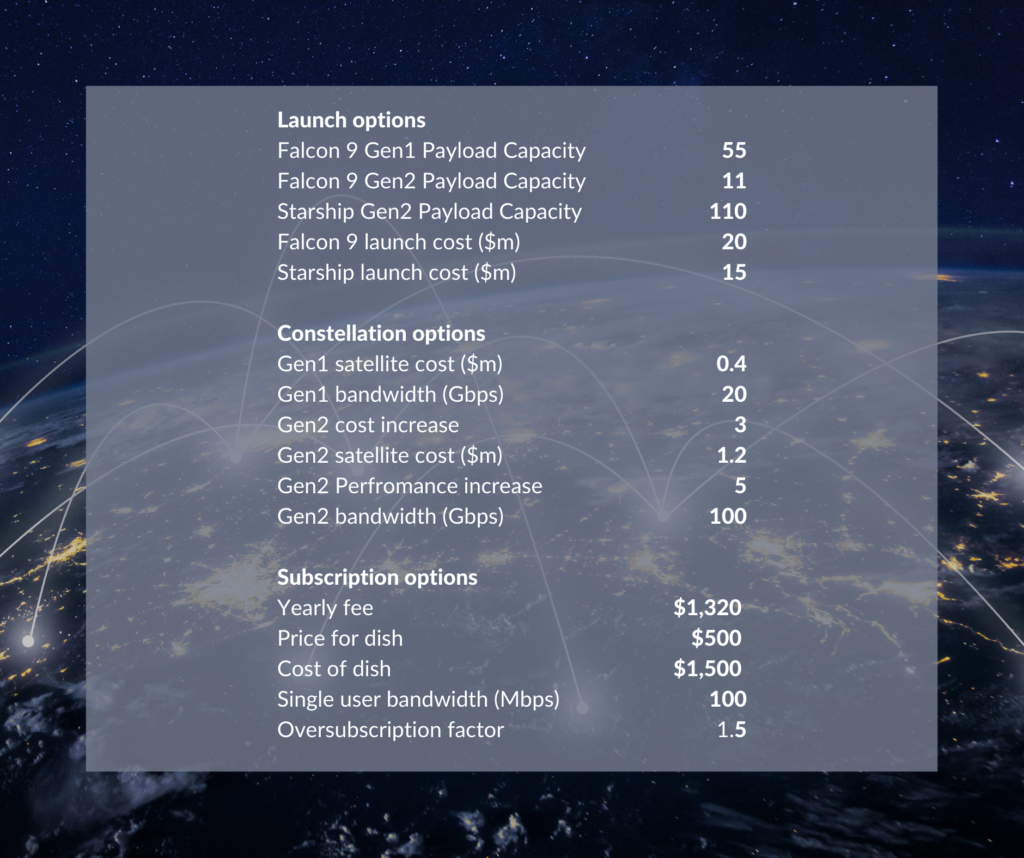

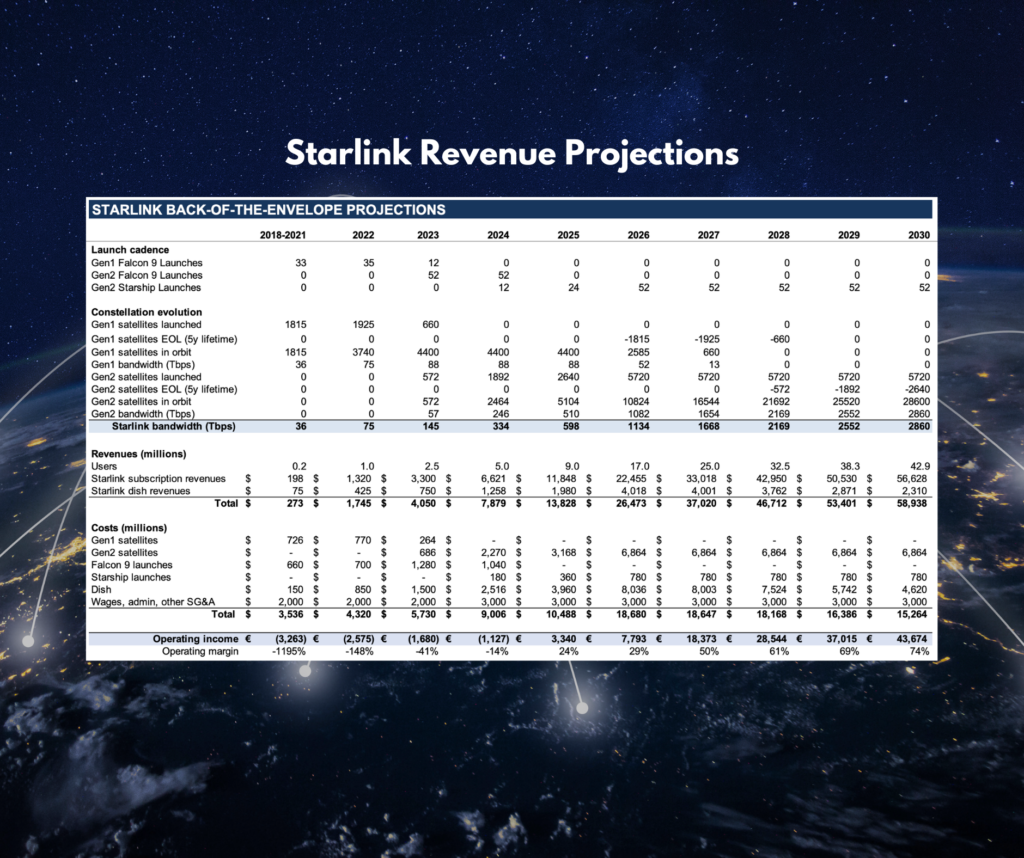

Now, time for some numbers. The below revenue and cost forecast is made for the entirety of the Starlink constellation, Gen1 and Gen2, up to 2030 using the below assumptions:

Another key assumption includes launch cadence: weekly Falcon 9 launches of Gen2 throughout 2023 (as mentioned by SpaceX) and 2024, with monthly Starship launches in 2024, twice-monthly in 2025 and weekly thereafter. This cadence results in approximately 30K satellites in orbit by 2030, in line with the FCC filing from last month, and would continually replenish the ~5,000 satellites that will decay on a yearly basis assuming a 5 year lifetime.

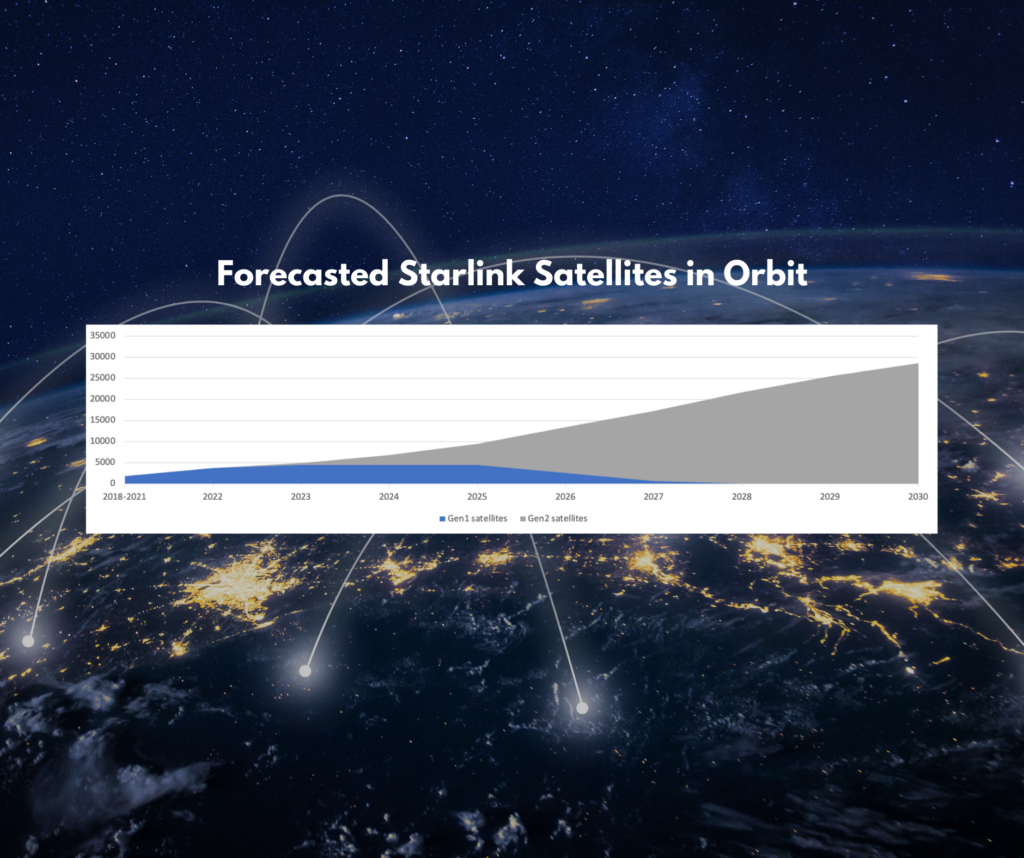

The following graph illustrates the resulting satellites-in-orbit evolution, reaching about 30,000 by 2030.

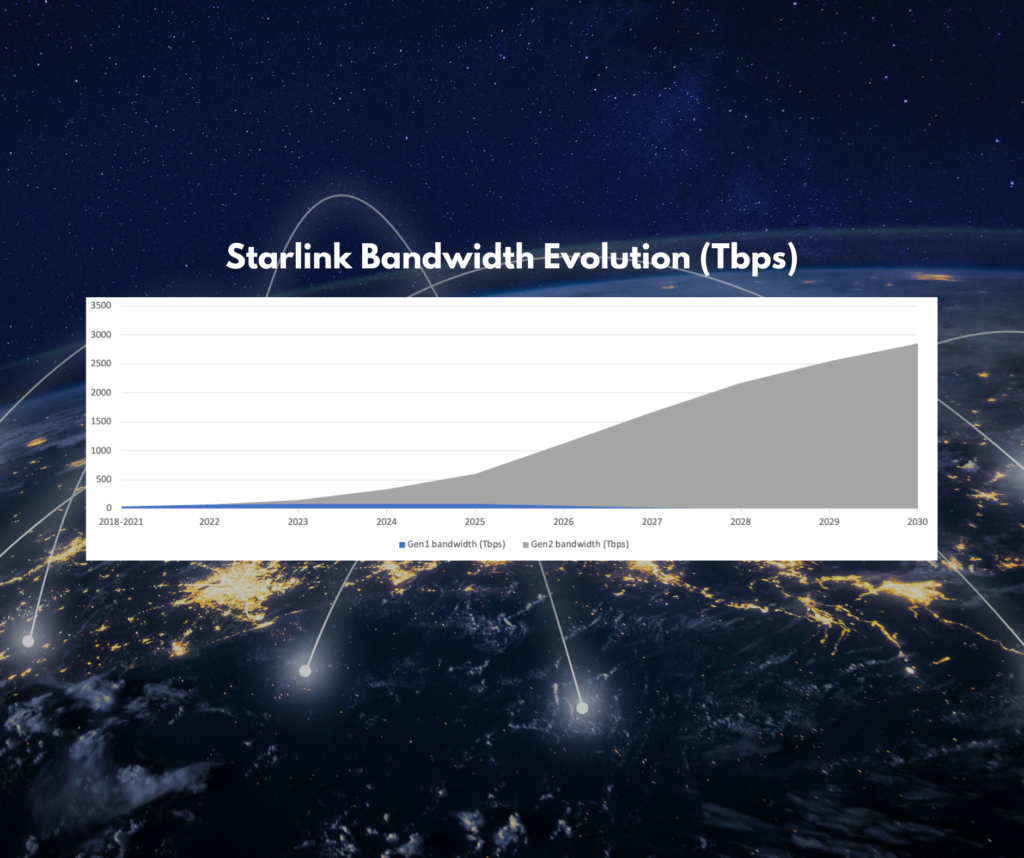

The forecasted bandwidth evolution furthermore illustrates the massive improvements that Gen2 brings in combination with Starship, as the Gen1 bandwidth falls nearly into insignificance.

As indicated above, but worth mentioning: the oversubscription factor for the full constellation is estimated at 1.5 for the below revenue and gross profit forecast. It is furthermore assumed that it costs $2b per year to keep the operations, staff, etc. running, increasing to $3b by 2024.

These back-of-the-envelope estimations clearly show the Gen2 business case is solid, enabled primarily by (1) a 10-fold increase in payload capacity for Starship, launching at a cost similar to Falcon 9 (or even lower), and (2) an increased capacity of the Gen2 satellites. The above launch cadence would enable the constellation to serve 9 million users by 2025 bringing in $14b in revenues, and when the 30,000 satellite-large Gen2 constellation is fully deployed by 2030, SpaceX could be looking at 40m+ users and $60b per year if demand holds up, with profit margins north of 70%. When trying to find the edge of profitability through a net present value (NPV) assessment, the analysis indicates that even with a 75% uptake in the available capacity (21m users by 2030), Starlink would remain profitable and realize a 10-year NPV of ~$3b assuming a 15% cost of capital.

Overall it looks like SpaceX’ mega constellation is here to stay if they can overcome key barriers such as liquidity, production issues and launch vehicle development, with the Gen2 business case enabling SpaceX to ‘print money’ if the demand holds up.