Indisputably, Earth Observation (EO) generates great economic value! Yet, for many EO-based solutions, the path from lab to the market is anything but guaranteed. As expected, securing cashflow during the early days (for operational costs, infrastructure set up, solution development, etc.), when risks are high and revenues mere projections, is vital. Consequently, this article explores funding opportunities relevant to service providers developing EO based solutions for commercial purposes, such as, for instance, many of the e-shape pilots.

Research and development (R&D) often lead to discoveries of commercial value but, financing being limited, not all of them make it onto the market. As a matter of fact, most European start-ups consider access to finance, alongside access to skilled labour, to be a major barrier in their development. In reality, turning R&D results into a commercially viable solution may actually require several rounds of investment which companies pursue by exploring a variety of avenues from the famous FFF pre-seed phase, to follow-up grants, and from crowdfunding to venture capital as discussed below.

EO attracting more public and private investments

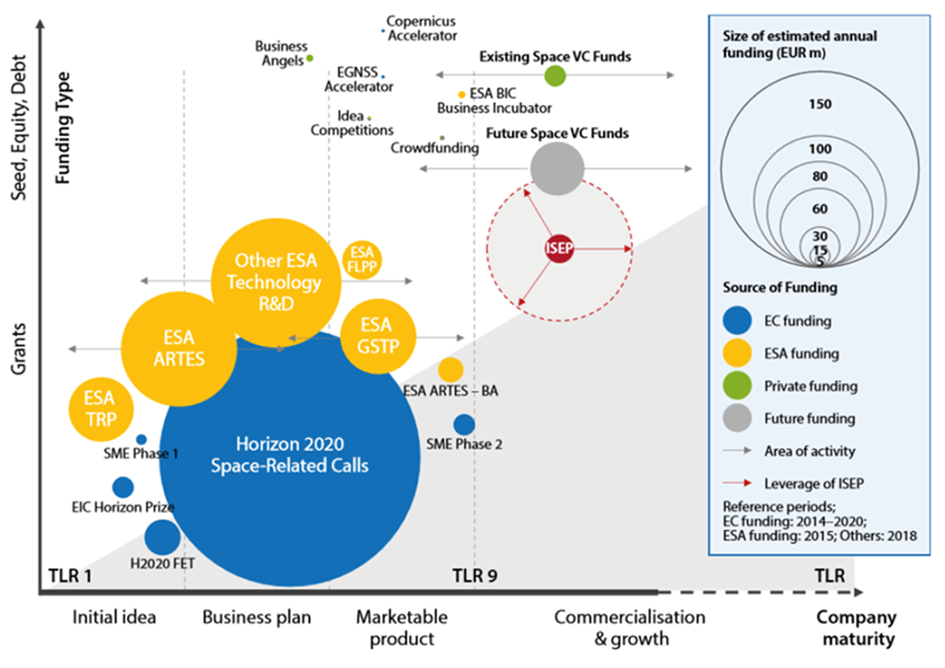

Companies from the space sector, EO included, attracted significant investments over the past years (see e.g. Seraphim Space Index) with venture capitalists (VCs) and angel investors accounting for two thirds of all investments, and satellite operators being the single biggest group of private investors overall (see Space Capital’s Space Investment Quarterly). However, most of this capital was raised in the USA and downstream solutions, including those based on EO, only benefitted a fraction of it. European space companies appear to rely mainly on public investors (see The future of the European space sector, EIB, 2019) in the early years, and struggle in finding dedicated financing opportunities during their growth phase – significant financing gaps apply as per figure 1 below.

Aside from “space” dedicated financing, EO companies seeking to develop solutions in a variety of sectors, could potentially benefit from sector specific opportunities such as food, energy, health, or from financing dedicated to enabling technologies such as deeptech, Big Data, etc. For instance, EIT InnoEnergy investing specifically in the energy sector also has some EO companies in their portfolio (e.g. Hepta, Steadysun). Similarly, Concrete VC, which focuses on the construction sector, also invests in EO companies such as bird.i or Orbital Witness.

As such, being aware of investment and funding opportunities (e.g. targeted industries and markets, company stage) may have significant impact on a company’s strategy and financial success. The e-shape Investment and Funding Landscape Navigator explores a selection of both public and private financing opportunities matching the profiles of the e-shape Showcases and Pilots.

Public Funding

Despite the increase in private investment, the largest amounts invested in the EU are from public money, available at EU-, Member State, or regional level through a variety of financing instruments and programmes. These typically target specific priorities or objectives –, e.g. employment, research, education, environment. EU funding programmes are designed and implemented by different departments of the European Commission or its executive agencies. To apply, specific criteria have to be met such as legal status, company location, sector, company size, specifics of employees, etc.

The EU’s biggest research and innovation programme providing grants is Horizon 2020 (to be succeeded by Horizon Europe as of 2021). Companies can apply to open calls and compete for these grants. As of 2021, Digital Europe, EU’s programme to accelerate recovery and drive the digital transformation of Europe, will be highly relevant to EO companies. Another large programme specifically targeting SMEs is COSME, which supports access to new markets. While also offering education, through their calls for proposals and calls for tenders, COSME provides both loan guarantees and equity funding.

The European Investment Bank (EIB) funds infrastructure projects in Europe. It offers loans, guarantees, equity investments, and advisory services to both public and private entities. Considering its current priorities e.g. climate and environment, or key infrastructure (e.g. transport, water, energy, urban spaces), and initiatives, e.g. ‘Sustainable oceans’, EIB’s instruments might be of relevance for e-shape’s Pilots and other service providers seeking to develop EO-based solutions. The European Investment Fund, owned by EIB and the EU, provides funding and guarantees (equity, debt, loans) to SMEs specifically. Its priorities are set on supporting EU’s objectives such as employment, growth, innovation, or regional development. As a joint initiative of EIB and EIF, InnovFin fosters access to finance for European companies undertaking innovation efforts. Financing tools include loans, guarantees, and equity funds, all provided through local financial intermediaries. The InnovFin Space Equity Pilot is dedicated to supporting innovation and growth amongst European companies active in the space sector across the EU (upstream and downstream) through venture capital funds.

Whilst most of the above instruments do not specifically, or exclusively, focus on space and / or Earth Observation, they do support activities in sectors of interest for the e-shape Showcases and Pilots. For instance, the LIFE programme, through its environment and climate sub-programmes, offers relevant funding opportunities. However, specific calls linked to Earth Observation are quite frequent too, see (i) the Funding & Tenders portal, (ii) tenders electronic daily (TED) and, most recently, (iii) the Green Deal tenders.

Other forms of public funding include prizes (e.g. Copernicus Masters, Horizon Prizes), accelerators (e.g. Astropreneurs, EIT Digital, EIT Food, EIT Urban Mobility, InnoEnergy, Copernicus Accelerator, PARSEC Accelerator), or incubators (e.g. ESA BICs, Copernicus Incubation). These may offer finance, access to facilities, trainings, or a combination of these. Zooming in on a couple of the above instruments, the Copernicus Masters target entrepreneurs developing applications based on Copernicus and manage to attract multiple applications on a variety of topics, often addressed by research institutes or (pre)-start-ups. The Copernicus Accelerator is a one-year coaching programme that starts and ends with a bootcamp whereby the participating start-ups are introduced to a mentor and provided with access to monthly online business courses. The Copernicus Hackathons aim to bring together young programmers and subject experts to develop novel software tools based on Copernicus data on an “ad-hoc” basis. The EC has been financing 20 Hackathons a year, across Europe but, besides these, Copernicus has also been featured in hackathons organised by e.g. OGC, Member States (e.g. in Austria), or EU-funded projects (e.g. the EO Big Data Hackathon). ESA’s business incubation efforts have supported more than 700 start-ups over the years with many success stories among them; ESA’s Incubed provides zero-equity co-funding, access to the Phi-lab, and personalised mentoring. Complementing this, the Copernicus Incubation Programme finances the incubation of 20 start-ups each year at an incubator of their choice (often an ESA BIC) besides a €50k grant for each start-up.

Private Investment

Most often than not, public funding aims to further attract financing from the private sector. Private investment may come from individuals, companies specialising in investments, corporations, banks, etc. Investment may be equity based (the investor purchasing shares; common for e.g. Venture Capital, Business Angels, or Private Equity firms) or equity free (e.g. through crowdfunding such as SpaceStarters, competitions, or debt investment). Such opportunities may vary with sector, geographical location, company stage, or investment stage.

Angel investors (or business angels) such as e.g. EBAN Space invest at early stages (i.e. seed stage) typically equity or debt-based. They are taking high risks and expect high returns on investment. Angel investors may invest as individuals or may take on the role of co-founders. Venture Capital (VC) firms (be these space-focussed – such as Seraphim, or with a broader portfolio – such as PromusVentures) provide equity funding to early stage and emerging businesses but their financial power is too small to raise capital in public markets or be able to get a loan from a bank. Corporate Venture Capital funds such as BayWa may decide to invest in external businesses motivated by advancing own operations, diversification, or purely as a financial venture. Private Equity firms typically invest in more mature businesses in exchange for a significant portion of their shares which allows them control over the business. Finally, debt financing, as opposed to equity-based financing, consists of loans that need to be paid back, often with interest. Such loans could potentially be secured from private investors, banks and non-banking financial companies, or monetary financial institutions. Debt financing can be accessed in the form of short-term loans to cover, for instance, operating costs or long-term loans to cover bigger expenditures such as certain infrastructure. But, as the risk of not being able to pay back appears higher in early-stage companies, they may experience difficulties in accessing such tools although loan defaulting usually results in investors recovering their money by seizing the company’s assets.

Investment Readiness

Effectively accessing financing from one of the aforementioned sources and, maybe even more relevant still, making the most out of the investment received, translates into being investment ready. This construct depends on a variety of factors such as legal status, geographical location, sector, innovation or company stage, technology readiness, market readiness, etc. Public funding programmes typically establish specific eligibility criteria, procedures and documentation. Private investors, on the other hand, may choose to share publicly a certain focus on industry, geography, and investment stage, yet not entirely reveal their selection criteria in choosing an investment. Once a company is deemed interesting by an investor they will initiate a solution feasibility assessment and further establish whether or not the available team is suitable to make it a success.

As both public and private funding and investment are highly competitive, those seeking investment or funding need to stand out not only by proposing a cutting-edge solution, but also by building a convincing business case, strategy, and team. Assuming the company manages to convince an investor, it then needs the capacity to negotiate terms and understand any contractual implications linked to the investment. As such, the e-shape Investment Readiness Support has been devised to help prepare the Pilots select the right type of investment and hopefully secure the most suitable funds or investors. This aim shall be achieved by – depending on needs and context – e.g. preparing business plans, pitch decks, and other documentation; providing training for pitching or proposal writing; understanding term-sheets; or introducing them to investors. If there is a gap in the market and a market in that gap, eventually financial resources will become available for those offering market-driven solutions, hence the scope of the e-shape sustainability booster and its various services.